CGS Tech is a next-generation Quant-AI trading framework that combines rigorous mathematics with explainable AI to deliver fast, transparent, and production-ready trading strategies.

At its core is CGS Engine — a multi-agent AI trading system coordinating thousands of specialized bots, each following disciplined, parameter-driven strategies. This architecture captures opportunities across shifting markets with precision, adaptability, and robust risk management—without relying on high-frequency trading.

Powered by Python for advanced modeling, PostgreSQL for data management, and specialized high-performance components, our modular, scalable infrastructure supports the full trading lifecycle—from research and testing to real-time execution and performance monitoring.

Key Highlights

- “No training — just adaptive evaluation” for rapid strategy development

- Explainable signals and transparent decision-making

- Scalable architecture designed for large-scale capital deployment

- Built for discipline and risk control, not speed-chasing

Table of Contents

- Key Capabilities

- Features

- Prerequisites

- Installation

- Configuration

- System Structure

- System Operations

- Backtesting Engine

- Execution Engine

- Multi-Agent Trading System

- Best Practices

- License

- Contact

Key Capabilities

Unified Quant-AI Trading Framework

- Mathematical Foundation: Core trading strategies based on algebraic and geometric analysis

- Integrated AI Approach: Seamless fusion of traditional quant methods with explainable AI techniques

- Single Ecosystem: Unified environment for development, testing, and deployment with consistent methodology

Bridging Technical Analysis with Intelligent Backtesting

- Enhanced Technical Indicators: Classic indicators reimagined with adaptive parameters and context awareness

- Market-Aware Testing: Backtesting that understands different market regimes and adapts accordingly

- Contextual Validation: Strategies tested across multiple timeframes and conditions automatically

No Training — Just Smart Math and Adaptive Evaluation

- Training-Free Implementation: Leverages mathematical optimization rather than heavy ML training requirements

- Adaptive Parameter Selection: Self-adjusting parameters based on market conditions without explicit model training

- Immediate Deployment: Strategies ready for production use without lengthy training cycles

Additional Capabilities

- AI-Enhanced Backtesting: Advanced pattern recognition and machine learning for strategy validation

- Hybrid Approach: Integration of traditional quant methods with modern AI techniques

- Automated Analysis: Intelligent categorization of market conditions and trading scenarios

- Risk Management: ML-driven risk assessment and position sizing

- Performance Optimization: AI-powered strategy refinement and parameter tuning

Features

- Automated trading bot development

- Advanced technical indicators

- Real-time market data integration with Binance

- Interactive visualization with Dash and Plotly

- Strategy development and optimization

- Risk management tools

- Performance analytics

- Backtesting framework

Prerequisites

Before installing CGS, ensure you have the following prerequisites:

macOS

# Install Homebrew if you haven't already

/bin/bash -c "$(curl -fsSL https://raw.githubusercontent.com/Homebrew/install/HEAD/install.sh)"

# Install TA-Lib

brew install ta-lib

# Install Node.js (required for mermaid-filter)

brew install node

# Install mermaid-filter globally

npm install --global mermaid-filter

Linux (Ubuntu/Debian)

# Install TA-Lib dependencies

wget http://prdownloads.sourceforge.net/ta-lib/ta-lib-0.4.0-src.tar.gz

tar -xvf ta-lib-0.4.0-src.tar.gz

cd ta-lib/

./configure --prefix=/usr

make

sudo make install

# Install Node.js and npm

curl -fsSL https://deb.nodesource.com/setup_lts.x | sudo -E bash -

sudo apt-get install -y nodejs

# Install mermaid-filter globally

sudo npm install --global mermaid-filter

Installation

# Clone the repository

git clone https://github.com/yourusername/cgs.git

cd cgs

# Create and activate a virtual environment

python -m venv venv

source venv/bin/activate # On Windows, use: venv\Scripts\activate

# Install dependencies

pip install -e .

Configuration

- Set up the cron job for automated updates:

crontab -e - Add your Binance API credentials to

.env:api_key="your_binance_api_key" secret_key="your_binance_secret_key"

System Structure

The CGS framework is built on a modular, scalable architecture that integrates multiple components for comprehensive trading operations.

Core Components

- Data Processing Layer

- Market data collection and processing

- Real-time data streaming

- Historical data management

- Data validation and cleaning

- Analysis Layer

- Technical indicator calculation

- Pattern recognition

- Market regime detection

- Signal generation

- Strategy Layer

- Strategy development framework

- Backtesting engine

- Performance analytics

- Risk management

- Execution Layer

- Order management

- Position tracking

- Risk controls

- Performance monitoring

Data Flow Architecture

Integration Points

- External Systems

- Exchange APIs

- Data providers

- News feeds

- Market sentiment sources

- Internal Systems

- Database management

- Logging and monitoring

- Performance analytics

- Risk management

- User Interfaces

- Web dashboard

- Command-line tools

- API endpoints

- Monitoring interfaces

System Operations

The system operations encompass the core workflows and processes that drive the trading system.

Data Management

- Data Collection

- Real-time market data

- Historical price data

- Order book data

- Trading volume data

- Data Processing

- Data cleaning and validation

- Feature engineering

- Technical indicator calculation

- Market regime classification

- Data Storage

- Time-series database

- Feature store

- Model registry

- Performance metrics

Trading Operations

- Signal Generation

- Technical analysis

- Pattern recognition

- Machine learning models

- Multi-timeframe analysis

- Order Execution

- Smart order routing

- Transaction cost analysis

- Execution algorithms

- Position management

- Risk Management

- Position limits

- Exposure monitoring

- Stop-loss management

- Portfolio hedging

System Monitoring

- Performance Tracking

- Real-time P&L monitoring

- Risk metrics calculation

- Strategy performance

- System health checks

- Alert System

- Risk limit breaches

- System anomalies

- Performance deviations

- Technical issues

Key Workflows

Backtesting Engine

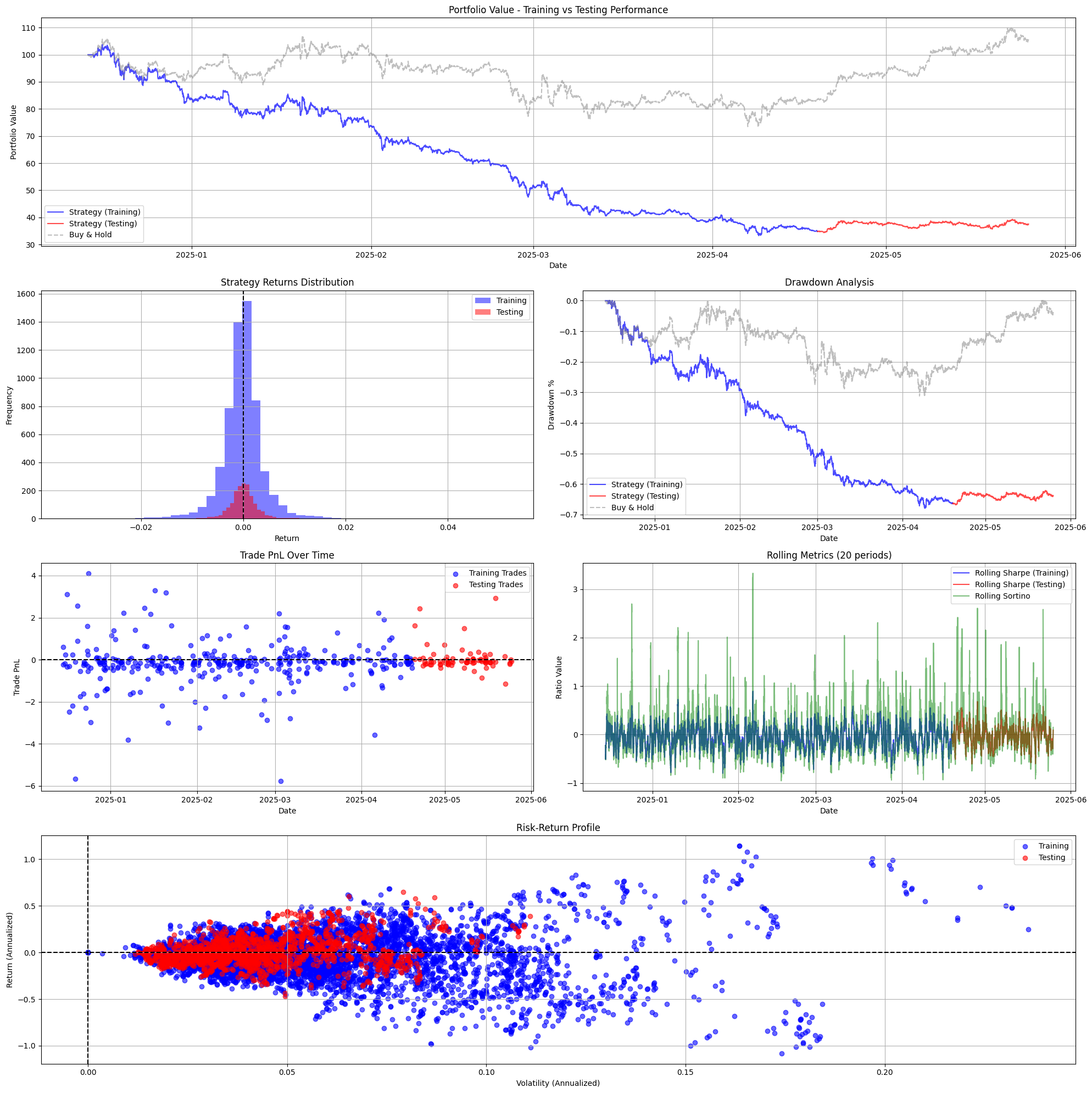

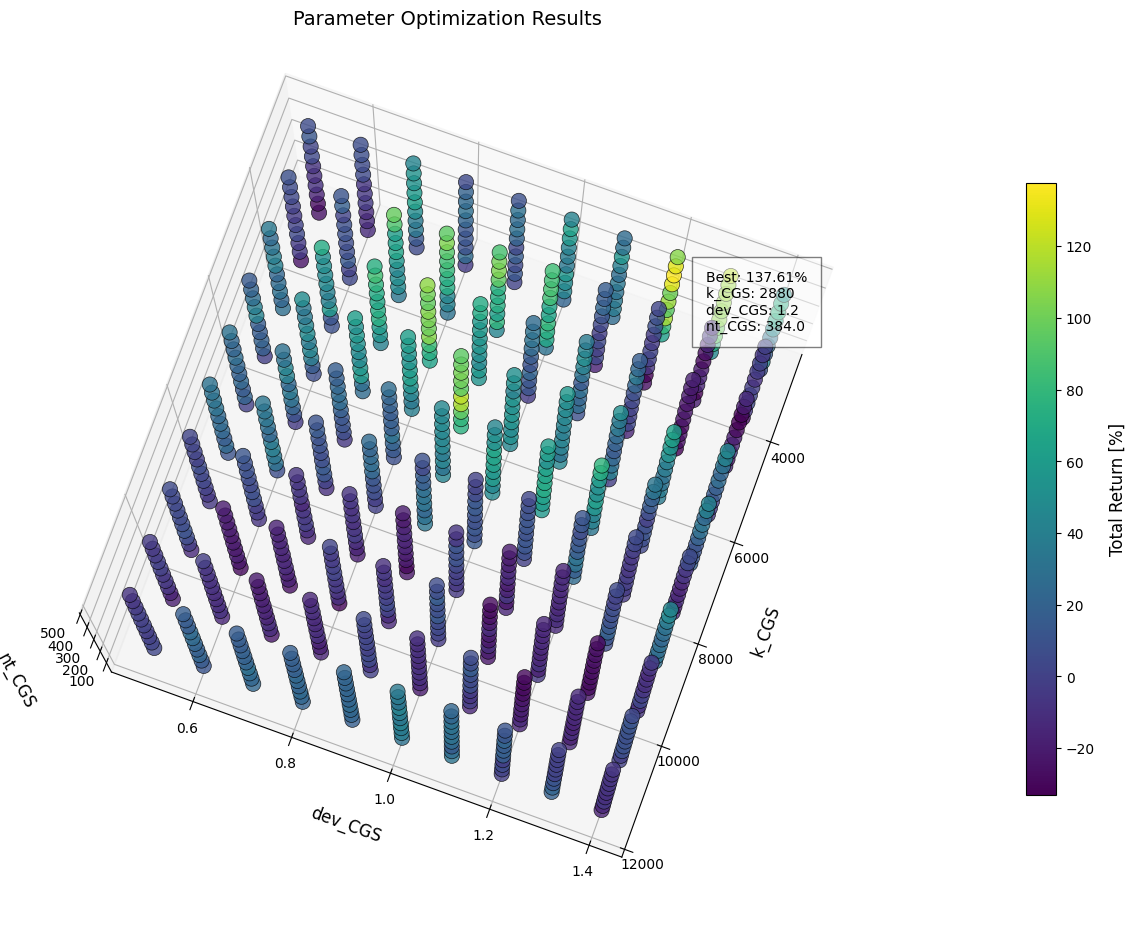

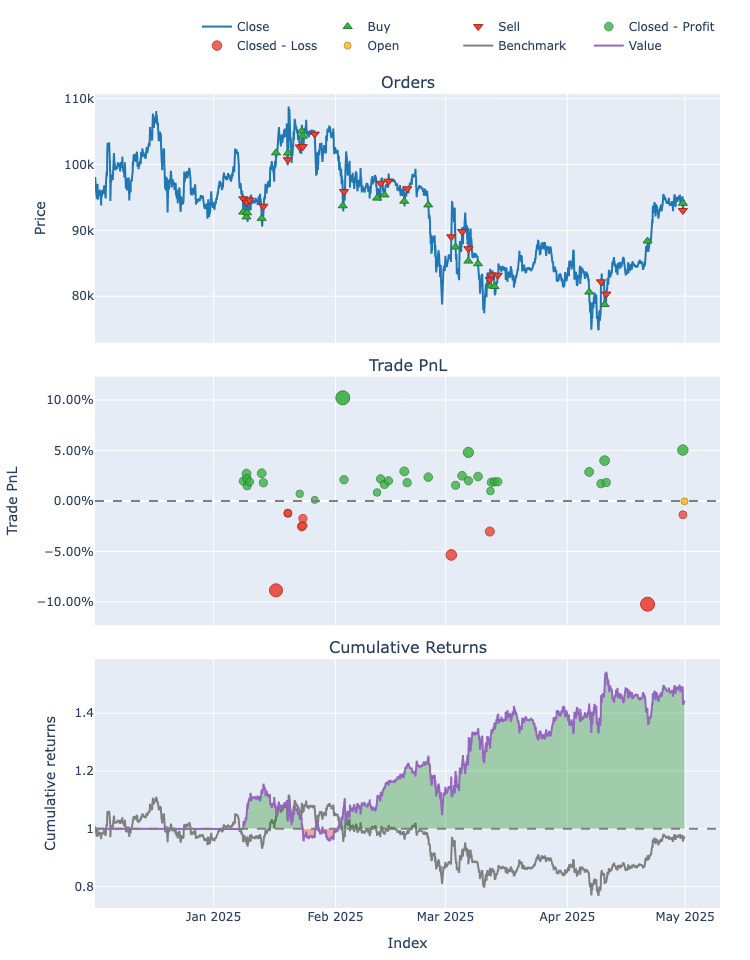

The CGS framework includes a powerful backtesting engine that combines traditional strategy testing with advanced AI/ML capabilities. This hybrid approach allows for both mathematical model validation and intelligent pattern analysis to optimize trading strategies.

Core Principles

The backtesting engine embodies the three core principles of the CGS framework:

- Unified Quant-AI Approach

- Mathematical models and AI techniques work together in the same evaluation pipeline

- Strategies can leverage pure quantitative logic, AI-assisted analytics, or any combination

- Results from different approaches can be directly compared within the same framework

- Intelligent, Data-Aware Testing

- Automatic detection and segmentation of different market regimes

- Contextual evaluation of strategy performance based on market conditions

- Adaptive parameter adjustment during backtesting to optimize for specific market scenarios

- Smart Math Over Training

- Robust mathematical optimization techniques instead of resource-intensive model training

- Immediate strategy refinement through intelligent parameter exploration

- Transparent, explainable results without black-box decision processes

Deep Reinforcement Learning

- Deep Q-Network (DQN) Implementation

- Neural network architecture:

- Input layer: 7-dimensional state space

- Hidden layers: 64 and 32 neurons with ReLU activation

- Output layer: Action space dimension

- Advanced RL features:

- Experience replay buffer (10,000 transitions)

- Target network for stable learning

- Batch training (32 samples)

- Adaptive exploration with epsilon-greedy policy

- State representation:

- Technical indicators (RSI, MACD, Bollinger Bands)

- Position information

- Historical performance metrics

- Normalized reward signals

- Neural network architecture:

- Training Methodology

- No pre-training required - learns from live market interactions

- Continuous learning and adaptation to market conditions

- Periodic target network updates for stability

- Automatic model checkpointing and loading

- Performance Features

- Real-time inference for trading decisions

- GPU acceleration support when available

- Memory-efficient experience replay

- Comprehensive reward shaping based on:

- Trade profitability

- Risk-adjusted returns

- Position holding costs

- Integration with vectorbt

- Seamless backtesting integration

- Performance visualization and analytics

- Trade execution and portfolio management

- Risk metrics calculation and monitoring

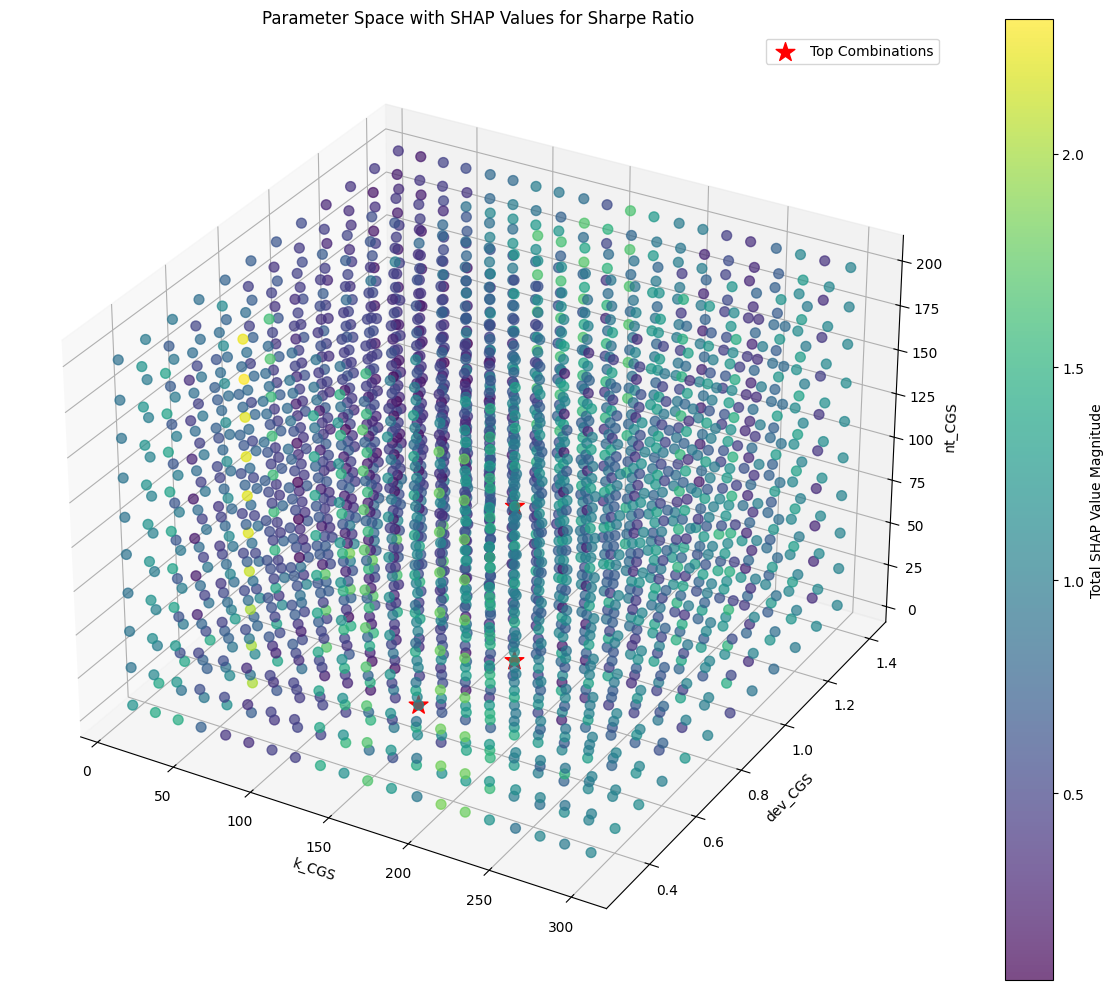

Explainable AI (XAI)

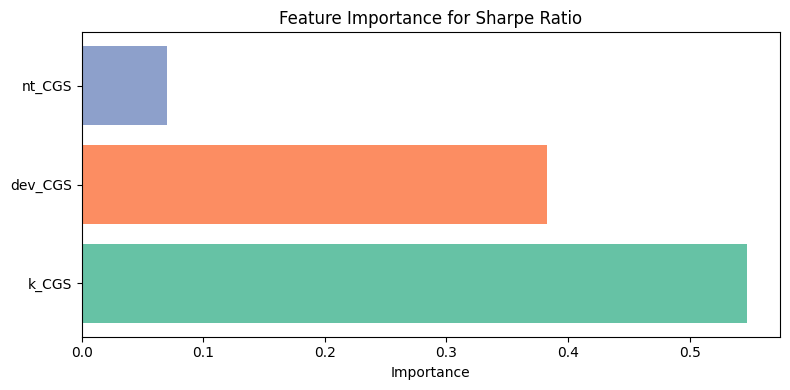

- Feature Importance Analysis

- Identification of key parameters affecting strategy performance

- Quantitative impact measurement of each feature

- Ranking of technical indicators by importance

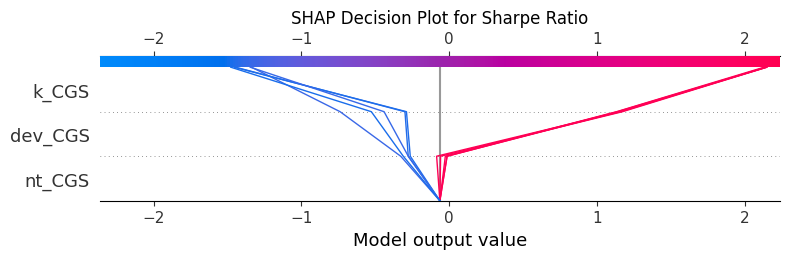

- SHAP (SHapley Additive exPlanations)

- Detailed contribution analysis of each parameter

- Individual feature impact quantification

- Complex interaction understanding

- Parameter Interaction Analysis

- Deep dive into feature relationships

- Cross-parameter effect measurement

- Optimization guidance through interaction understanding

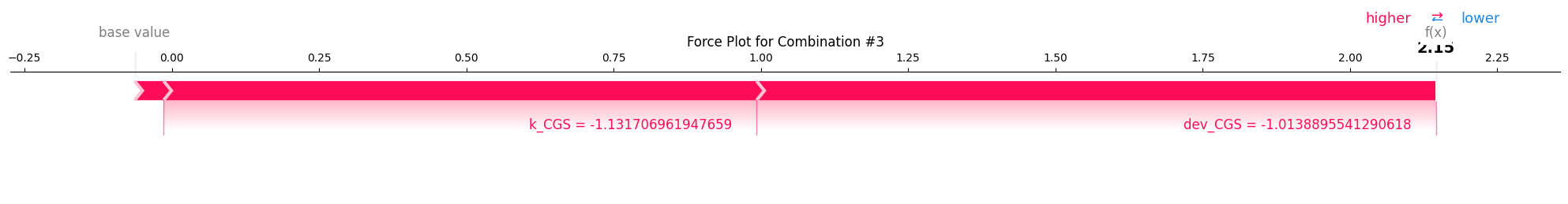

- Detailed Parameter Analysis

- Force plots for specific combinations

- Individual decision explanation

- Strategy behavior interpretation

- Optimal Parameter Selection

- Best combination identification

- Performance attribution

- Robustness analysis

- Key Benefits

- Overfitting prevention through transparency

- Parameter sensitivity understanding

- Focused optimization guidance

- Clear strategy behavior explanation

- Market adaptation insights

Bridging to Production

- Parameter Validation and Optimization

- Comprehensive parameter space exploration

- Multi-objective optimization considering:

- Risk-adjusted returns

- Transaction costs

- Market impact

- Execution feasibility

- Robust parameter sets identification

- Market Regime Analysis

- Automatic regime detection and classification

- Strategy performance evaluation across different regimes

- Adaptive parameter adjustment based on market conditions

- Real-time regime monitoring and strategy adjustment

- Production Readiness Checks

- Liquidity requirements validation

- Transaction cost analysis

- Risk limit compliance verification

- Technical infrastructure requirements

- Failsafe mechanism testing

Execution Engine

The CGS Execution Engine provides a robust framework for managing trade execution, risk controls, and position management in real-time trading environments.

Order Management

- Order Types:

- Market orders

- Limit orders

- Stop orders

- OCO (One-Cancels-Other) orders

- TWAP (Time-Weighted Average Price) orders

- VWAP (Volume-Weighted Average Price) orders

- Order Routing:

- Smart order routing across multiple exchanges

- Liquidity aggregation

- Price improvement algorithms

- Slippage minimization

- Order Lifecycle:

- Pre-trade validation

- Order placement and monitoring

- Execution tracking

- Post-trade analysis

- Error handling and recovery

Risk Controls

- Pre-Trade Checks:

- Position limits

- Exposure limits

- Margin requirements

- Volatility checks

- Market impact analysis

- Real-Time Monitoring:

- Position tracking

- P&L monitoring

- Risk factor analysis

- Market condition assessment

- Circuit breaker triggers

- Post-Trade Analysis:

- Execution quality metrics

- Slippage analysis

- Market impact assessment

- Performance attribution

Position Management

- Position Tracking:

- Real-time position updates

- Cost basis calculation

- Unrealized P&L tracking

- Position sizing optimization

- Portfolio Management:

- Asset allocation

- Risk budgeting

- Correlation analysis

- Portfolio rebalancing

- Hedging Strategies:

- Delta hedging

- Cross-exchange hedging

- Options-based hedging

- Portfolio-level hedging

Performance Monitoring

- Real-Time Monitoring:

- Real-time P&L monitoring

- Risk metrics calculation

- Strategy performance

- System health checks

Multi-Agent Trading System

The CGS framework implements an advanced multi-agent trading system that combines multiple specialized trading bots working in concert to achieve optimal trading performance while maintaining controlled risk exposure.

System Scale and Operation

- Massive Parallel Processing: Operating between 200 to 2000 robo-traders simultaneously

- 24/7 Market Monitoring: Continuous surveillance of market conditions

- Real-Time Data Driven: Actions based purely on market data observations, not predictions

- Strategic Capital Allocation: Independent operation with predefined parameters and algorithms

Trading Cycle Algorithm

Each robo-trader follows a sophisticated 5-step trading cycle:

- Initial Operation

- Search for equilibrium signals while in standby mode

- Monitor market conditions continuously

- Process real-time market data

- Equilibrium Signal Capture

- Detect and validate equilibrium signals

- Maintain standby state while preparing for potential trades

- Preserve current market state information

- Preliminary Signal Betting

- Place initial positions when uptrend/downtrend signals are confirmed

- Execute trades based on trigger conditions

- Monitor signal strength and validity

- Post-Analysis and Signal Confirmation

- Evaluate signal authenticity for true uptrend/downtrend patterns

- Decision making:

- If signal confirmed: Maintain current betting position

- If signal invalid:

- Execute loss-cutting procedure

- Process market noise data

- Recalibrate for next preliminary signal

- Return to steps 3-4 for new signals

- Position Management

- Hold betting positions until new equilibrium signal emerges

- Close positions for profit when next equilibrium signal appears

- Return to step 2 to restart the cycle

Agent Architecture

- Specialized trading agents for different market conditions

- Coordinated decision-making through a central controller

- Real-time communication and state sharing

- Dynamic role assignment based on market conditions

Coordination Framework

- Real-time position mirroring across multiple agents

- Risk-adjusted position sizing for each agent

- Synchronized entry and exit strategies

- Cross-agent position correlation management

Risk Management

- Distributed risk allocation across agents

- Individual agent risk limits

- Portfolio-level risk controls

- Dynamic risk rebalancing

System Integration

- Seamless integration with existing trading infrastructure

- Real-time monitoring and control

- Automated agent deployment and management

- Performance analytics and reporting

Key Advantages

- Superior Upside Potential: Identifying and capitalizing on market deviations

- Lower Risk Profile: Data-driven decisions without predictive assumptions

- Scalable Architecture: Ability to handle hundreds to thousands of agents

- Real-Time Adaptation: Quick response to changing market conditions

- Systematic Execution: Well-defined parameters and algorithms governing all operations

Best Practices

- Parameter Optimization: Use explainable AI techniques to optimize trading parameters

- Risk Management: Implement robust risk controls to manage market volatility

- Performance Monitoring: Continuously monitor trading performance and system health

- Multi-Agent Trading: Utilize advanced multi-agent systems to leverage market opportunities

License

Copyright (C) 2025 CGS Engine Quants, All Rights Reserved

Contact

For questions and support:

- Open an issue in the GitHub repository

- Email us at contact@cgstech.co